Write Off Bad Debt Double Entry

New provision of 2 of 200000 which comes Rs 4000. Journal Entry for the Direct Write-off Method.

Writing Off An Account Under The Allowance Method Accountingcoach

Provision for bad debts Ac.

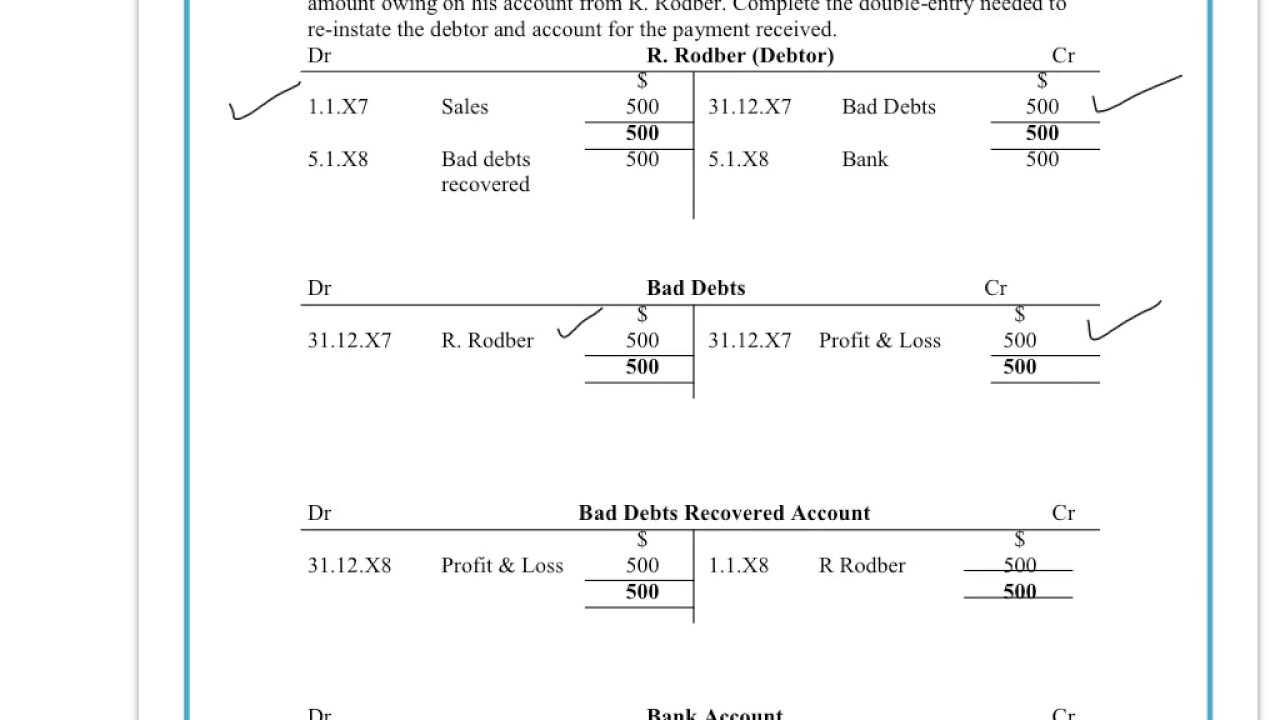

. Bad Debts Written Off Income Statement 2000. Therefore it records it as written off bad debts as follows. Dr Bank 5000 Dr Bad debts 8700 Cr Debtors control 13700 Here we are saying that we are recording a loss of 8700 bad debts.

In such case it. For example the company ABC Ltd. Suppose a business identifies an amount of 200 due.

Here provision for bad debts for last year is given in trial balance is given. From this amount the company can calculate the allowance for bad debts which will be 9000 90000 x 10. Based on our past experience we determine that this amount is unlikely to be recoverable as we have tried many possible ways in the collection of receivables for many months but to no avail.

However on June 12 2021 Mr. Bad debt is a loss for the business and it is transferred to the income statement to adjust against the current periods income. Accounting entry required to write off a bad debt is as follows.

D paid the 800 amount that the company had previously written off. The double entry for a bad debt will be. Assuming the estimated losses from bad debt at the year-end of 2020 is USD 3000 the company will need to make an allowance for doubtful accounts of.

The sale was still made but we need to show the expense of not getting paid. Direct write-off method Allowance method Under the allowance method the company records the journal entry for bad debt expense by debiting bad debt expense and crediting allowance for doubtful accounts. DEF LTD Receivable 500.

After this double entry the remaining balance in accounts receivable will be 90000 100000 10000. Already has 7000 in the provision for doubtful debt accounts from the previous year. As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10.

The entries shall be made as under-. It means we have to make new provision and also adjust it with old provision which is still with us. The total amount of the bad debt written off is 50000 which belongs to our customers that made the credit purchase.

Hence the allowance account after writing off will remain as a debit balance of USD 500 2000-1500. Ms X should write off Rs. We then credit trade receivables to remove the asset of someone owing us money.

1000 from Ms KBC as bad debts. The double entry will be as follows. Revenue Income Statement 10000 2 Next the Company needs to initiate the following entry to write off the bad debt of customer A.

Expects 12 of the remaining balance to be doubtful. Now as provision for bad debts 2 on debtors is to made. An allowance of Rs.

Bad Debt Expense. Accounting and journal entry for recording bad debts involves two accounts Bad Debts Account Debtors Account Debtors Name. 1 The original double entry when the Company billed customer A is.

In this case the company ABC needs to make two journal entries for this bad debt recovery of Mr. Journal entry for bad debts is as follows. Do we have to make two ledgers of bad debts and bad debts recovered by.

Please provide the journal entries to be made for bad debt. D by debiting the 800 into accounts receivable and crediting the same amount into the allowance for doubtful accounts in the first journal entry. Had the credit sales amount to USD 1850000 during the year.

Must recognize the specific bad debt related to XYZ Co. Create Your Customized Template Demand Letter Online in 5 Minutes. Occasionally a bad debt previously written off may subsequently settle its debt in full or in part.

Debit bad debt expense account Credit trade receivables We debit the bad debt expense account we dont debit sales to remove the sale. Trade Debtor Balance Sheet 10000. This is using the direct-write off.

Manjinder Suppose a company becomes insolvent with balance 13700 and could pay 5000 - what are the entries. Note that the provision for bad debts on 31122017 is Rs. The double entry will be recorded as follows.

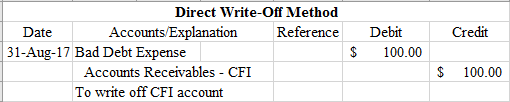

One method of recording the bad debts is referred to as the direct write off method which involves removing the specific uncollectible amount from accounts receivable and recording this as a bed debt expense in the income statement of the business. Ad Create a Demand Letter for Debt Owed Action Required or for Insurance Claims.

Understand How To Enter Bad Debts Recovered Transactions Using The Double Entry System Youtube

Bad Debt Overview Example Bad Debt Expense Journal Entries

Writing Off An Account Under The Allowance Method Accountingcoach

Allowance Method For Bad Debt Double Entry Bookkeeping

Direct Write Off Method Double Entry Bookkeeping

0 Response to "Write Off Bad Debt Double Entry"

Post a Comment